Get to know California’s new interconnection rules

This post was written by Josh Weiner, Solar Expert Witness & Solar Engineering Expert. Mr. Weiner has been at the forefront of the solar industry for over 20 years and is an industry leader on solar project development. Josh’s expertise spans both in-front of and behind-the-meter initiatives including residential, commercial & industrial, utility, grid-scale, and ev charging solar and storage applications.

Highlights

Highlights

This summer, the California Public Utilities Commission rolled out a new set of rules for utilities to decide when solar and energy storage projects get permission to interconnect with the grid. We’ll share some information that has helped us understand what’s happened, plus a short Q&A we put together with support from the Interstate Renewable Energy Council (IREC), an advocate for regulations supporting clean energy adoption and a driving force for the new rules.

Interconnection is a mission-critical step in renewable energy project development. To get interconnection approval, projects have to show they can operate safely and reliably and prevent grid disruptions. Projects need an interconnection agreement before they can start exporting energy to the grid.

California, like many states, has had long-standing rules to screen projects for potential to compromise grid reliability so projects can be approved to interconnect faster when the risk of grid disruption is de minimis. But as more renewable energy projects come online, fewer projects are passing this screen.

Out: 15% limits on annual peak load

Under the old rules, projects passed this screen, avoiding additional time-consuming studies by the utility, if distributed energy made up less than 15 percent of the annual peak load on the nearest electric distribution lines. Once distributed generation topped the 15 percent limit, projects could be held up for further review. In a recent PV Magazine article, one project developer said commercial and industrial solar projects often wait more than three years for interconnection approval.

California’s new rules ditch the 15 percent threshold and replace it with a more precise analysis of the grid’s operational limits, known as a hosting capacity analysis (HCA). The analysis, as described on the IREC website, shows where distributed energy projects can seamlessly interconnect to the grid. It also shows where solar and storage can add value to the grid and where network upgrades are needed most.

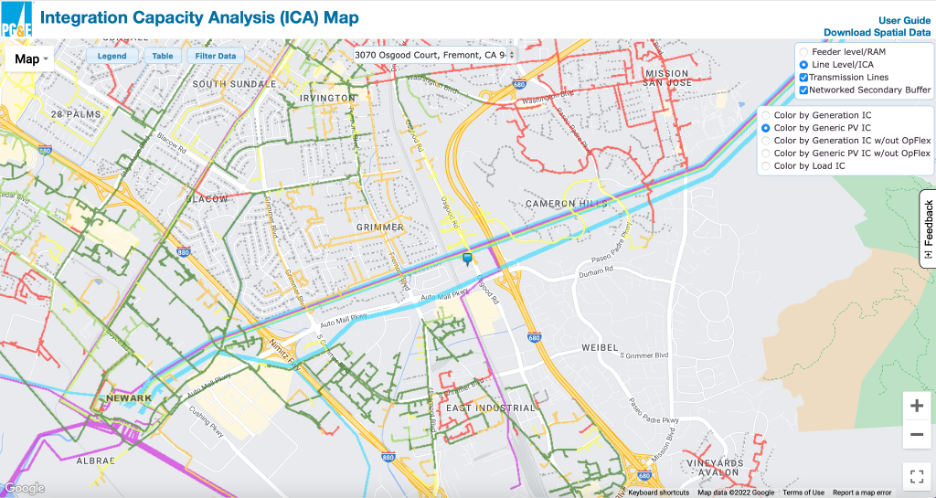

Want to find out how suitable a project site would be for solar and energy storage projects? Here are maps with results from the latest analyses for California’s three investor-owned utilities.

PG&E and SDG&E require you to register and login before viewing their maps. PG&E provided instant access. SDG&E granted us access after a six-day wait.

The Sepi team would like to smooth the transition for the California contractors we work with, and help inform the manufacturers, contractors and consultants we’re in contact with throughout the industry. See our Q&A with IREC Communication Director Gwen Brown below. Responses have been edited for length. If you have more questions, share them with us on LinkedIn.

What should California contractors do to get prepared for the new interconnection process before it takes effect?

Familiarize yourselves with the hosting capacity analysis of the investor-owned utilities in the territories where you operate.

In: Hosting capacity analysis

How easy is it for contractors to view a hosting capacity analysis to know how a project might be affected by grid constraints in the interconnection process?

Searching an HCA map is like searching any online map, like Google Maps. Just enter the address to view a section of the grid and select the data you want to display. Each map has a legend and user guide for reference.

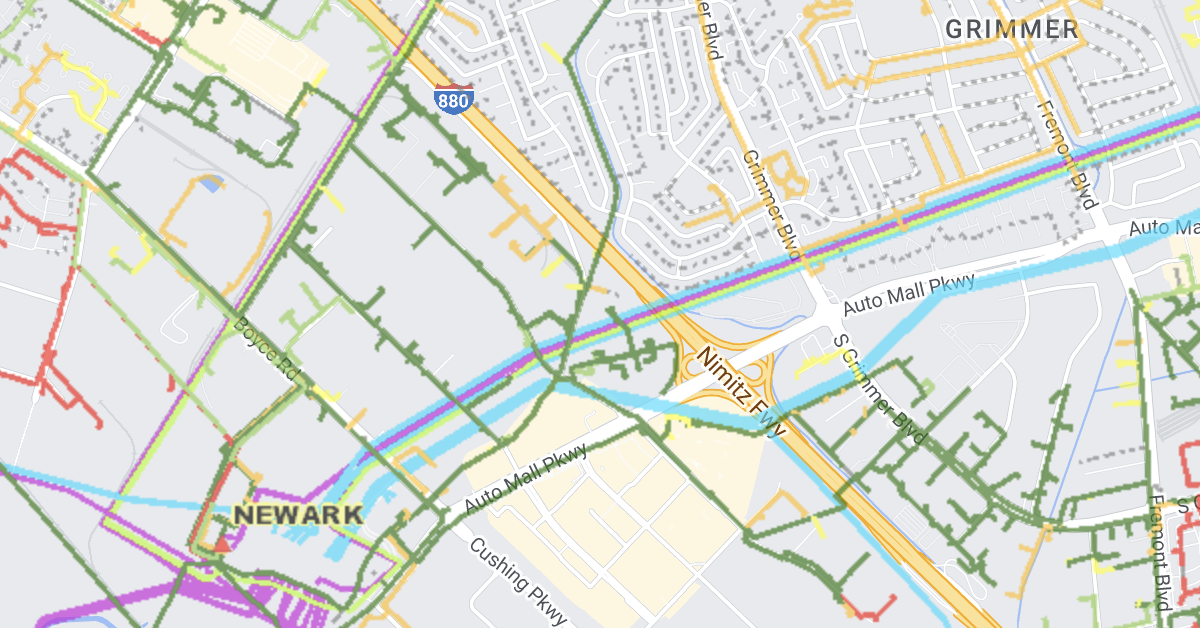

Here’s a map of the grid closest to the SepiSolar office in Fremont, California, showing the amount of PV generation that can be installed without any thermal, voltage, distribution protection or operational flexibility violations at the time the HCA analysis was performed. Lines with no capacity are colored in red. Lines with more than 2 MW of capacity are green. Purple and light blue show transmission and feeder lines.

Using tables, you can also view HCA data to find out precisely how much capacity is available for new generation.

Which projects will be eligible for expedited review?

The HCA is the new form of expedited review for all distributed energy resource projects, including solar and energy storage on both sides of the meter. From IREC’s press release: “Under the newly adopted rules, projects that do not exceed 90% of available capacity as shown in the ICA (a conservative buffer requested by utilities) will be able to pass the new screen. Projects that do not pass this improved screen will be subject to supplemental reviews; however, the rule changes also include significant improvements to the supplemental review process that are expected to allow a greater amount of DERs to be integrated through the screening process.”

All projects are now eligible for this review process. If you know a project will fail the HCA screen (that is, it exceeds 90 percent of available capacity), you might want to take another path, such as going directly to supplemental review.

When will contractors notice a difference in the interconnection queue?

Good question. Nobody truly knows the answer yet. It depends how the utilities manage the transition. Review times may vary from one utility to the next. In theory, at least, HCA maps can allow for rapid approval where the grid shows capacity for new projects.

The future of interconnection in California and beyond

Will there be differences in the way projects are treated across California’s three investor-owned utilities, its munis, and other electric service providers?

The process should be the same for each of the investor-owned utilities. Munis and other providers may not have the resources to perform an HCA. The details for each utility can be found in utility advice letters submitted during regulatory proceedings. Here is PG&E’s 342-page advice letter. The advice letter from Southern California Edison can be found here. A search for the file from SDG&E, Advice Letter 3677-E-B, on the utility’s web page hosting electric filings to the CPUC produced no results.

Is there any indication that another state will soon follow in California’s footsteps on streamlined interconnection?

According to IREC’s records on hosting capacity adoption in the US, last updated in February, 16 states are using HCA data in some form or another. The group includes New York, New Jersey, North Carolina, Michigan, Colorado, and Hawaii. A major limitation here is that the HCA has to be of high quality in order to be used for grid interconnection. California was the first to develop HCAs and has the best systems. A handful of other states (see HCA page linked above) have HCAs but most still have further work to do to get them to the point that they are ready for this application.

What other changes can California and other states make going forward to further simplify interconnection?

In the future, the plan per prior proceedings is that hosting capacity data will be used to allow developers to propose seasonal operating profiles for their projects so they could limit export in times when the grid has excess generation (such as spring, before load increases with AC use), and export more during times when that generation is needed on the grid (in summer). That concept was approved in Sept. 2020. Further work is needed to iron out the details. The timeline for that proceeding remains unclear. To learn more about emerging standards for scheduling the import and export of solar, energy storage, and other distributed energy resources, see Chapter 9 of IREC’s BATRIES toolkit for storage and solar-plus-storage interconnection.

Feature image by PG&E, accessed Sept. 1, 2022. PG&E updates ICA values on a monthly basis when significant changes to the feeder occur. Register for an account and login to see the most up-to-date maps in your service territory.